Going through with Japanese unfamiliar documentations and process may frustrate you. When you have a trouble at bank or any public services, just contact us. We will assist you and get you what you need. Japanese public service systems are so complicated even for local Japanese.

Japan Tax Return:

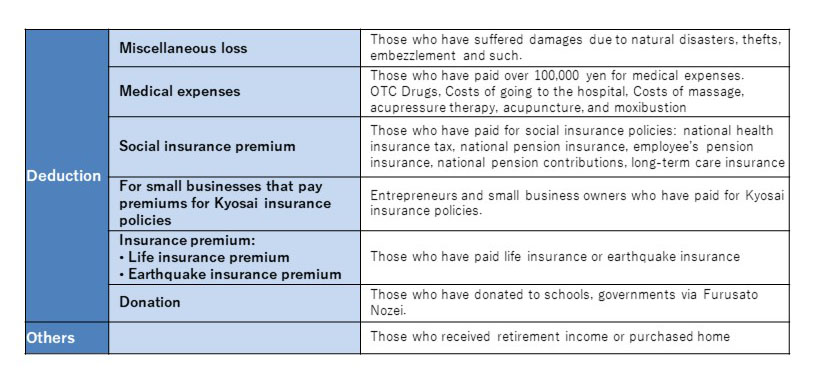

Japanese income tax is paid annually on income earned during a calendar year. The tax return for 2018 had to be filed between February 16 and March 15, 2019, however, many people don’t know that the period of tax returns for 2018 is January 1, 2019 to December 31, 2023 if you are getting refund. For those who didn’t claim tax return properly in past years, they can file a tax refund back to the past 5 years. If you have any of these below, you might get a refund, particular for those who received retirement income, purchased home or got family member changed.

You can claim tax refunds at Japanese tax offices by your tax agent, “Nozei-Kanrinin”. Any person living in Japan can be your tax agent. If you left Japan without reporting your tax agent, you can submit the form when you file your claim for tax refund.

Notification and Application for Approval of the Resident Tax Administrator (Minato-ku)

Japan Pension System

It is mainly composed of national pension insurance (kokumin nenkin) and employees‘ pension insurance (kosei nenkin). All residents of Japan who are between 20 and 60 years of age, including foreign residents(on temporary working, spousal or permanent residence visas) are required to enroll. You are exempt from Japanese pension if overseas company pays your salary and you are seconded to a company in Japan. If some salary is paid from a company in Japan, your employer in Japan must put you in Japanese pension. If you have 10 years or more of valid coverage periods, you are eligible for Japanese old age pension at age of 65 or over. instead of 25 years. This will be bi-monthly payment every year until your death, not onetime payment.* The “complementary period of coverage” is a valid period though not actual coverage periods. The complementary period, however, will not be reflected to the pension amount. If you have coverage periods of certain countries which have totalization agreement with Japan, you may be eligible for totalized benefits from Japan or/and the other country, if you meet certain conditions.

To receive lump-sum withdrawal payment up to 36 months of pension payment, you had to claim within 2 years after the date you no longer have a registered address in Japan. The refund system requires some significant paper work, it is a way for those non-Japanese who have contributed to the pension system to get a portion of their contributions returned and remitted to their oversea bank account . Once one applies for and receives a lump-sum refund, all other months of coverage are then void. if you decide to return to Japan again later to work, you would have no accrued pension credit left. You would be starting all over again from scratch. If you want to find out more about your pension, please contact us! It can be handled by the Power of Attorney from overseas.

Sample:

Paid Pension Premium Amount : 37 months, JPY 2,264,864

Lump-sum Withdrawal Payments Received: JPY 1,942,848

Income Tax Refund: JPY 477,088 (20.42%) * Income tax return has to be filed separately with local tax administrator

Total Refund: JPY 2,419,936

Please check for more information from Japanese Pension Office below:

Japanese National Pension System

Lump-sum Withdrawal Payments(Japanese/English)日本から出国される外国人のみなさまへ_Eng

Medical Emergencies:

In the event of immediate attention or an emergency, the first thing to do is call 119 for assistance; if you are in Tokyo, an English-speaking operator will be able to help you, but outside of Tokyo it might be difficult find an operator who is able to understand English. Just contact us with as much of the following information as possible: name, gender, age, address, description of location using landmarks, and the reason for immediate assistance. We will assist you quickly.

Should I go to Hospital or call an Ambulance? When you need help with sudden injury or illness.

Check with Tokyo EMS Guide.

Direction, lost & found and crime reports

When you lose a key, wallet or passport, you go to the nearest police box first and ask if it has been picked up and brought in by somebody. If it hasn’t, then you should submit a report of lost property at the police box describing in detail where you lost it and what shape of key or wallet it is. For any further assistance, just contact us. We will help you communicating with police quickly.

Tokyo Metropolitan Police Department

例:Car accident with a rented car during vacation in Japan. Assisted reporting with police station and car rental office.

Childbirth

All births in Japan must be registered within 14 days of the child being born. When a foreigner residing in Japan gives birth to a child in Japan, the necessary steps which must be taken are:

<Register Baby Birth>

1) Registering the birth of your baby at the local government office (ward office, etc.)

2) Reporting birth to your Native Country (to the foreign embassy in Japan)

3) Applying for Status of Residence (visa) at the local immigration office

<Health Insurance Benefit>

“The Childbirth and Childcare Lump-Sum Grant” is paid when an insured person gives birth and “the Dependents’ Childbirth and Childcare Lump-Sum Grant” is paid when a dependent family member gives birth. 420,000 yen of birth allowance for each delivery (404,000yen if the clinic (midwife) is not identified as the “obstetric compensation system” one, or you delivered abroad) which is directly paid to your hospital/clinic from Kyosai Health Insurance Bureau and offset against your total cost related to your delivery and hospitalization cost. You will receive an additional 40,000 yen as a supplemental allowance later.

<Enroll in your Health Insurance program>

<Medical Subsidies for Children>

<Child allowance>

Phone

Phone

There is no review yet.